Bitpanda Review

Bitpanda is a European trading platform that offers cryptocurrencies, as well as equities and commodities, with a variety of products suitable for traders of all levels of experience. Their native BEST token offers discounts and VIP tiers with unique benefits. Their fees are usually minimal, although those for deposits and withdrawals are not always straightforward, as they vary per asset. Through a single account, you can pick between a basic and professional exchange. Bitpanda also has mobile apps for both Android and iOS if you like to trade on the go. Pros & Cons

• Low costs One account for two exchanges Discounts with native token Governed exchange Strong safety

• Not accessible in the United States Required verification The fee structure might be complex.

Bitpanda Review: Principal Functions

Bitpanda is an all-levels trading platform that offers more than just cryptocurrency trading. Among their most noticeable characteristics are:

• Their own local currency, BEST. If you have a sufficient number of tokens and use BEST, you can receive charge reductions and VIP service.

• Two exchanges inside a single account In addition to the standard Bitpanda exchange, which simply allows you to buy and sell assets, you also have access to the Bitpanda Pro exchange, which allows you to submit more complex orders if you feel comfortable doing so.

• Bitpanda Plus for institutional investors and high-volume traders. Bitpanda also caters to individuals who wish to trade in excess of the norm, which comes with a unique set of benefits as well as account opening conditions.

• Five fiat currencies supported. Bitpanda primarily caters to Europeans, hence it supports EUR, GBP, CHF, and TRY fiat currencies, as well as USD.

• Trading of stocks, metals, indexes, and ETFs. In addition to cryptocurrencies, Bitpanda enables trading in the aforementioned assets. All of these are contained in a single account and portfolio, allowing you to manage all of your investments from a single location.

• Extensive helpdesk. Bitpanda’s helpdesk covers the vast majority of issues you may encounter, but if it doesn’t, their customer support team is available to assist you, allowing you to exactly categorise your request.

Bitpanda Background and History

Bitpanda was formed in 2014 in Vienna, Austria, with the intention of democratising investment. The company was formerly known as Coinimal, but they changed its name to Bitpanda in 2016 after expanding their feature set. Bitpanda boasts over 2.5 million customers and over 400 team members in 2021 and claims to be one of Europe’s most rapidly expanding fintech startups.

The exchange was formed by co-CEOs Eric Demuth and Paul Klanschek, with Christian Trummer joining the team a few months after Bitpanda’s inception. The three of them comprise the business’s core personnel.

The company’s payments service is licenced as a PSD2 payment service provider, a European standard for electronic payment services. The exchange is a registered service provider for digital assets with the Austrian Financial Market Authority (FMA) under FM-GwG and the French Autorité des marchés financiers (AMF) under PACTE regulation. Citizens of the United States and several other jurisdictions, depending on their regulatory structure, are prohibited from using the exchange. However, the exchange’s website does not identify other banned nations.

Everyone who wishes to trade on Bitpanda must have their account verified. The exchange has verification levels that determine your trading volume based on the documents you have submitted and whether you match the standards. Before beginning the verification procedure, users will be required to submit a genuine mobile phone number. After receiving a PIN code from Bitpanda, you can proceed with the transaction. Regarding identification documents, Bitpanda recognises passports, while ID cards from a limited number of countries are accepted.

Additionally, the exchange employs a technique known as a verification deposit. After account verification, you must deposit between EUR 25 and EUR 2,500 using bank transfer (SEPA), SOFORT, or GIROPAY/EPS. Prior to then, EPS/GIROPAY and SOFORT deposits are limited to €2,500; this amount will be extended once a verification deposit has been made. The verification deposit can also be made in similar quantities of CHF, GBP, or USD, however cryptocurrencies cannot be deposited until this process has been completed.

After the verification process has been finished, there are still some restrictions. 10,000 EUR is the 24-hour limit for online payment methods such as NETELLER, Skrill, and iDEAL. Credit card deposits are limited to €2,500 each 24-hour period, whereas bank transfers can reach €500,000. If you do not sign up for a Bitpanda Plus account, none of these limitations can be adjusted.

BEST Token

The Bitpanda Ecosystem Token is Bitpanda’s native token (BEST). Users can receive a 20% reduction on trading and deposit fees, as well as trading premiums, with this token. There is also a minimum value for BEST, which is 0.132 EUR in 2021 and will climb by 10% annually over the next five years. Quarterly, a portion of the tokens used for trading premiums are burned until just 50 percent of the overall quantity remains.

Additionally, the token introduces VIP accounts based on the quantity held. If you possess at least 5,000 BEST and are a VIP level 1 member, you get a vote in strategic choices, such as which assets are introduced next.

Bitpanda Plus

Bitpanda’s premium account tier is known as Bitpanda Plus. Designed specifically for traders that transact in big numbers and must exceed the exchange’s limits, this service offers lower trading costs and premiums upon request and generally takes a more personalised approach. To qualify for Bitpanda Plus, you must satisfy at least one of the following requirements:

• You earn at least EUR 150,000 (gross) annually or have EUR 500,000 in liquid assets.

• You are a holder of BEST VIP level 3.

• You actively promote Bitpanda on your website or operate an affiliate business (more than 1,000 fully-verified users referred to Bitpanda)

• You own a minimum of 2,500,000 PAN tokens

• You have at least one deposit of 100,000 EUR or its equivalent

• You have utilised Bitpanda since 2014

On the website, users who meet any of the conditions can apply. Before being accepted, users may be required to submit further documentation to support their applications.

Bitpanda Design and Usability

Bitpanda’s user interface is basic and intuitive. By selecting Get Started, you will be brought to a page where you will be prompted to provide your complete name, email address, country of residence, and create a password. Follow the link at the bottom of the page if you’re interested in opening a business account. Once your email address has been confirmed, you will be asked to answer a series of questions required by EU anti-money laundering (AML) regulations, the majority of which concern your annual income and trading intentions, as well as verify your account by providing the required identification documents. You are not need to finish the verification immediately; however, keep in mind that you will be required to return to it at some point. You will not be allowed to deposit funds or begin trading until this process is complete.

Bitpanda does not demand you to create separate accounts for its basic and Pro exchanges. Following account creation, you will be asked which exchange you wish to visit first. There are no navigational issues between the two; the only difference between the interfaces is that the basic exchange has a lighter colour scheme than the Pro version.

If you are a complete novice or want simplicity and ease of use, the basic exchange is your best option. It is incredibly user-friendly, requiring only a few clicks to execute trades. There is extremely little likelihood that a misclick will lead you down a route you don’t comprehend due to the interface’s tidiness. However, the exchange also displays the top movers at the top of your screen; this is beneficial when you want to monitor the market without continually focusing on the top few coins by market capitalization.

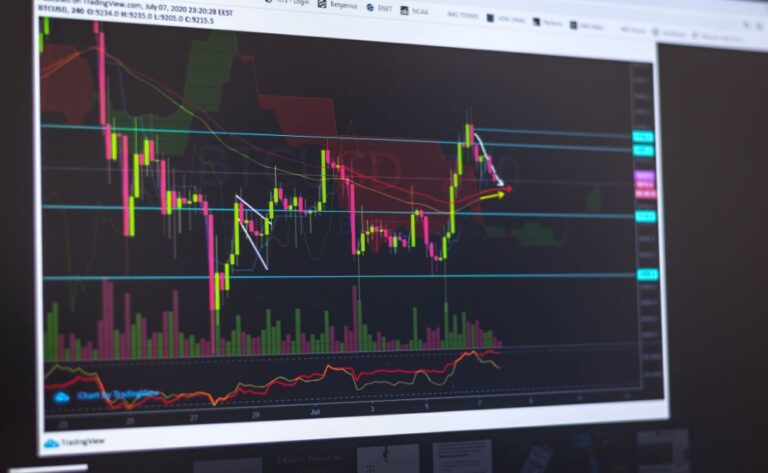

Bitpanda Pro, however, provides many more possibilities. The UI itself is much more similar to what many users are accustomed to seeing on other exchanges, with every detail you may require contained in a single location. Bitpanda does a great job of keeping its trades uncluttered and simple on the eyes, without compromising any essential information. As Bitpanda is a European exchange, you shouldn’t be surprised by the pricing; if you don’t specifically convert them to US dollars, they will be displayed in euros. This will result in a lower number owing to the disparity between the two currencies, not a precipitous decline in any asset.

You will be able to put limit and stop orders on Bitpanda Pro if you do not wish to trade an asset at the market price. Even in this case, you can decide how complicated you want the deal to be, i.e. how many options you want to have. On the left side of the page, you may select the type of order you wish to place, and the limit order screen has a little checkbox next to the Advanced option, allowing you to specify the time in force and the execution. If you do nothing, the exchange will use the default parameters, but if you know what you’re doing and need to set other parameters, you can do so.

Bitpanda also offers an app for both Android and iOS; however, the exchange cautions that not all desktop functions may be available on the mobile version, but adds that they’re striving to transfer them so that users can use both platforms interchangeably. Nevertheless, the Bitpanda Pro app is distinct from the standard exchange app, so if you prefer the more powerful desktop version, be sure to install the correct software on your mobile device.

Bitpanda Client Service

There are multiple ways for clients to receive assistance on Bitpanda. The first is the Bitpanda Helpdesk, where numerous inquiries regarding any aspect of the exchanges are addressed. Just beneath the search box on the Helpdesk homepage, you may select whether your issue pertains to the standard exchange or the Pro edition. Underneath that, the questions and answers are categorised by subject, and the most-visited sites are listed separately at the bottom.

If it does not assist, you may contact their customer service team. You will be presented with a contact form that allows you to select the type of inquiry you’re making and the general topic of your request. The site then displays an overview of the topic itself (in case you couldn’t find it before, as it may answer your question) in case you couldn’t find it before. Select your favourite language (English, German, French, Turkish, Italian, Spanish, and Polish are available), enter the email address you used to establish your account, and describe your problem. You can also attach files, such as screenshots, to help the team resolve your issue. The team at the exchange attempts to respond to all help requests within 72 hours, though they note that it could take longer and that no request is overlooked or forgotten.

Bitpanda also features a community where users can discuss topics unrelated to their accounts, such as price fluctuations, coin listings, and general developments and their impact. Additionally, the community can be of great assistance with some difficulties. However, the exchange warns that they do not respond to help requests via social media and that consumers with serious inquiries should use the aforementioned contact form.

Bitpanda Protection

Bitpanda stores their assets in cold storage, however they do not say how much is stored offline. The exchange has never been hacked and claims to employ cutting-edge security methods to prevent it. When it comes to user accounts, Bitpanda will always require you to verify your identity through your email address whenever you’re accessing them from a new device, as well as use reCAPTCHAs and conduct spot checks with you when you’re changing important account information, such as your email or phone number. The exchange provides DDOS protection in addition to SSL encryption.

Bitpanda is registered with the Austrian Financial Market Authority (FMA) and the French Autorité des marchés financiers as a digital asset service provider (AMF). The Bitpanda Payments organisation is PSD2 compliant.

Regarding what users may do to secure their accounts, Bitpanda is similarly vigilant. In addition to being prompted to select a secure password, you are encouraged to use two-factor authentication.

Regarding external reports on Bitpanda’s security, only the Pro exchange has been examined by specialists. At the time of writing, CryptoCompare gave Bitpanda Pro an A for security and ranked it twenty-first overall out of nearly 140 exchanges. The exchange is now regarded as one of the most secure on the market.

Deposit and Withdrawal Methods for Bitpanda

The process of depositing bitcoins to your Bitpanda account is really simple: simply transmit the assets from your personal wallet to the account’s wallet by copying the address or scanning the QR code. You have one address for each asset; if you wish to obtain more addresses to make your assets less traceable, you must first use the existing address. Bitpanda’s support page provides a comprehensive description of each asset and any deposit-related considerations you must bear in mind, including any peculiarities a coin may have. Upon receiving six confirmations from Bitcoin miners or the comparable degree of security on other networks, deposits will be automatically credited.

You can also deposit fiat currency. To accomplish this, you must select the currency of your deposit, which must be one of the following:

• Euro (EUR)

• US Dollar (USD)

The Swiss Franc (CHF) (CHF)

• Sterling Pound (GBP)

• Turkish Lira (TRY)

You must also select the payment source you wish to employ. Verified accounts can fund their Euro Wallet via SEPA, GIROPAY/EPS, SOFORT, NETELLER, Skrill, Visa, and Mastercard. Bitpanda To Go vouchers can also be exchanged directly for cryptocurrency. Other fiat currencies have a somewhat more limited selection of payment providers; for instance, the Turkish Lira can only be deposited by bank transfer. The exchange provides a detailed explanation of the characteristics of each currency. Except for bank transfers, you must confirm your deposit with an SMS-PIN that you will receive after entering all the necessary information. The cash will shortly be added to your account.

Withdrawals will vary based on whether the funds are fiat or cryptocurrency. Withdrawing from your fiat wallets is likewise straightforward: you select the payment provider and, if required, open a payout account with them (often only required the first time you withdraw), enter the amount, and confirm. For fiat, the minimum deposit and withdrawal amount is 25 EUR or its equivalent in other currencies.

Withdrawing cryptocurrency is equally simple. From the Send option in the upper-right corner, you must pick the asset, enter a sum, and input the recipient’s address. When withdrawing ETH, you must additionally declare that you are not investing in an ICO and that you realise Bitpanda cannot credit your account with ICO-issued tokens, which would result in their loss. Depending on the coin, withdrawals to your personal wallet take as long as it takes to receive all confirmations.

Additionally, Bitpanda offers the Contacts tool to streamline the withdrawal process. This allows you to save an address as a contact so that you don’t have to copy it every time you send payments from your Bitpanda account. In addition, if your contact is the address of a different Bitpanda account, i.e., another user, those transactions are free and performed in a matter of seconds. You require only the email address with which the other person registered their account. Regarding external wallets (such as your own crypto wallet), nothing has changed besides the fact that you can now preserve your address instead of entering it manually every time.

Review of Bitpanda: Conclusion

Bitpanda is a well-rounded exchange that offers more than is typical in the cryptocurrency space. There is something for everyone, regardless of their level of experience, and the fact that you can utilise both of their exchanges with one account allows you to level up without the inconvenience of opening and authenticating another account. Their attention to security means you won’t have to worry about where your funds are being sent, and the comprehensive explanations of everything you want and need to know will keep you informed at all times.